Construction Industry Outlook

By Anna Liza Montenegro | Event, News

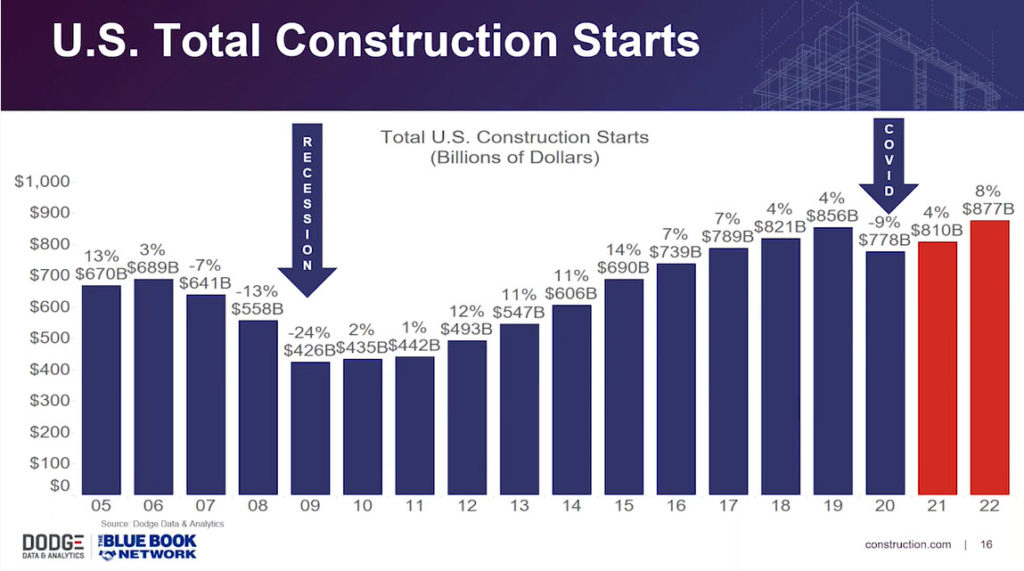

2020 was an unforgettable year in many ways and one that may have permanently changed the world. 2020 and the early part of 2021 saw a downturn in construction starts. But as we’re reaching the mid-year point, things are starting to look up.

The architecture, engineering, and construction (AEC) industry were able to respond faster than other industries due to strong order books and demand from the residential segment.

2020 likely also helped AEC companies to reset and prepare sooner and more effectively for work, workforce, and workplace changes. The year ahead is only expected to accelerate these changes.

Connected construction presents a host of efficiency- and productivity-enhancing technologies that can enable new business models and strategies.

There may be another disruptive event around the corner that could catch the world off guard. But AEC firms that embrace digital, form strategic alliances, and prepare for the future of work are most likely to be better prepared for whatever comes next.

Dodge Data & Analytics’ Steven Jones shares the mid-year outlook program. Steven is a globally recognized expert in how emerging economic, practice, and technology trends are shaping the future of the design and construction industry. He speaks at conferences globally, authors the SmartMarket Report series on key industry trends, and hosts the ENR FutureTech events.

Steve outlines the national and regional starts forecast for 2021 and 2022, respectively, across our residential, nonresidential building, and nonbuilding sectors. The highlights will include those factors impacting the economic upturn now that the economy is starting to improve.

Watch this video and gain an understanding of the current market situation and a macroeconomic overview.

Steve does a deeper dive into what Dodge Data & Analytics think is going to be happening with the infrastructure bill. He shares some of what they’re learning in their quarterly surveys about the business health construction companies’ both commercial and civil projects. Steven also looked at some high-frequency planning data to help the industry continue on its path to recovery.

Residential Construction

The pandemic has pushed many city dwellers to the suburbs as they look to avoid health concerns surrounding urban mass transit and public crowding. Near-record, low mortgage rates are expected to promote continued residential construction growth. Steve expects single-family home construction starts will rise as much as 7% in 2021; however, multi-family homes “will pay the price for single family’s gain,” with the dollar value of multi-family starts anticipated to fall by 1% this year.

Commercial Building

After dropping 23% in 2020, Steve forecasts a 5% dollar value increase in commercial starts in 2021. Steve also reports that “[w]arehouse construction will be the clear winner as e-commerce giants continue to build out their logistics infrastructure.”

Anirban Basu, the chief economist for Associated Builders and Contractors, reports that COVID-19 accelerated these preexisting commercial construction trends. Basu explains, “Among the most obvious trends in e-commerce, a trend that was gaining market share even before the global health crisis began. An ongoing proliferation of fulfillment and data centers will serve this ongoing boom. However, this could translate to tougher times ahead for retailers and shopping centers . . . .” Development site consultant Tom Stringer expects suburban commercial construction to grow as companies look to move offices away from densely populated areas and build new manufacturing and distribution centers to help alleviate pandemic supply chain issues.

Public Works

Steve expects public construction to remain relatively flat but stable during 2021. According to Basu, “Countervailing forces are at work in public construction. On one hand, weakened state and local government finances suggest weaker public works spending going forward. On the other hand, . . . federal spending on infrastructure could increase as part of a post-inauguration stimulus package. Republicans and Democrats do not agree on much, but leaders from both parties agree that America spends too little on infrastructure.” While the federal government recently extended the FAST Act (for Fixing America’s Surface Transportation), any growth in the public sector likely will depend on the further stimulus or infrastructure bills.

Utility Construction

With the growing push for renewables and other climate change initiatives, experts anticipate energy construction, especially large-scale solar and wind projects, will rise significantly. Steve forecasts a 35% gain for utilities and renewable energies construction in 2021.

Summary

The construction industry is showing signs of growth in 2021 and beyond, but such growth may be checked by uncertainty and COVID-19’s lingering effects on construction operations. Contractors will continue to face pandemic-related time and cost impacts from added safety measures (PPE, physical distancing, screening), workforce shortages, and supply chain disruptions, all of which can cause delays, accelerations, and production losses.

Contractors can manage these risks and enhance profitability by taking affirmative steps to protect their rights and claims under their contracts. Proactive measures include asking for extensions of time, ensuring compliance with all contractual notice requirements, and carefully tracking all extra work and costs.

For a continuing construction industry forecast, visit Dodge Data & Analytics.

INDUSTRIES: Architecture, Buildings, Civil Engineering, Construction, MEP Engineering, Structural Engineering