Why use Section 179 tax savings for your software purchases?

By Warren Wolf | News

Section 179 is an attractive tax deduction for businesses. An increasingly popular use of the Section 179 deduction is for software. When you buy software or equipment for business use, you can get tax deductions for buying and using them.

If you own a small business, the Section 179 deduction is one of the most essential tax codes you need to be familiar with. It lets you deduct all or part of the cost of equipment purchased or financed and put into place before December 31, 2023.

Section 179 Tax Deductions for 2023

This year, the Section 179 current deduction limit is $1,160,000 on qualifying equipment, and the limit on equipment purchases has increased to $2.89 million.

In addition, the bill allows businesses to depreciate 100 percent of the cost of eligible equipment bought or financed from January 1, 2023, through December 31, 2023.

How Much Can I Save on My Taxes This Year?

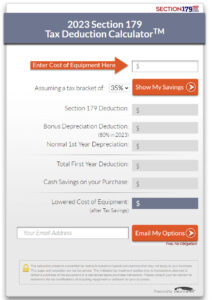

It depends on how much-qualifying equipment and software you purchase and put into use this year. To show you your expected tax savings, you can check this link to a Section 179 Calculator.

When Do I Have to Do This By?

Section 179 always expires at midnight, December 31st. So to take advantage of Section 179 this year, you must buy (or lease/finance) your equipment, and put it into use, by December 31st of this year.

To enable you to leverage an affordable payment option, you can also use a Lease Finance option.

How do I use Section 179?

To elect to take the Section 179 Deduction, simply fill out Part 1 of IRS form 4562, available for download at Section179.org.

Not all types of equipment qualify; therefore, you should consult your accountant or tax professional before making any purchases. If you do not feel comfortable completing the form yourself, your tax preparer can easily take care of form 4562 for you. Your tax preparer may also be able to advise you of additional Section 179 Deductions and Bonus Depreciation savings that may be available to you.

If you’d like to take advantage of Section 179 before the end of the year and purchase your software now, contact your Microsol Resources Account Executive or email us at info@microsolresources.com.

INDUSTRIES: Architecture, Buildings, Civil Engineering, Civil Infrastructure, Construction, Manufacturing, Media & Entertainment, MEP Engineering, Structural Engineering